The numbers tell a puzzling story. According to the American Medical Association, over 71% of physicians now use telehealth weekly – triple pre-pandemic rates. Yet fewer than 30% of healthcare executives report significant ROI from their virtual care platforms. This isn’t a technology failure. It’s a measurement and implementation problem that most organizations are getting wrong.

The adoption-value paradox: high use, low returns

Telehealth adoption has become nearly universal. From small primary care practices to large health systems, virtual care is now standard operating procedure. But when administrators review their platform investments – often six figures for deployment and ongoing costs – the financial returns frequently disappoint.

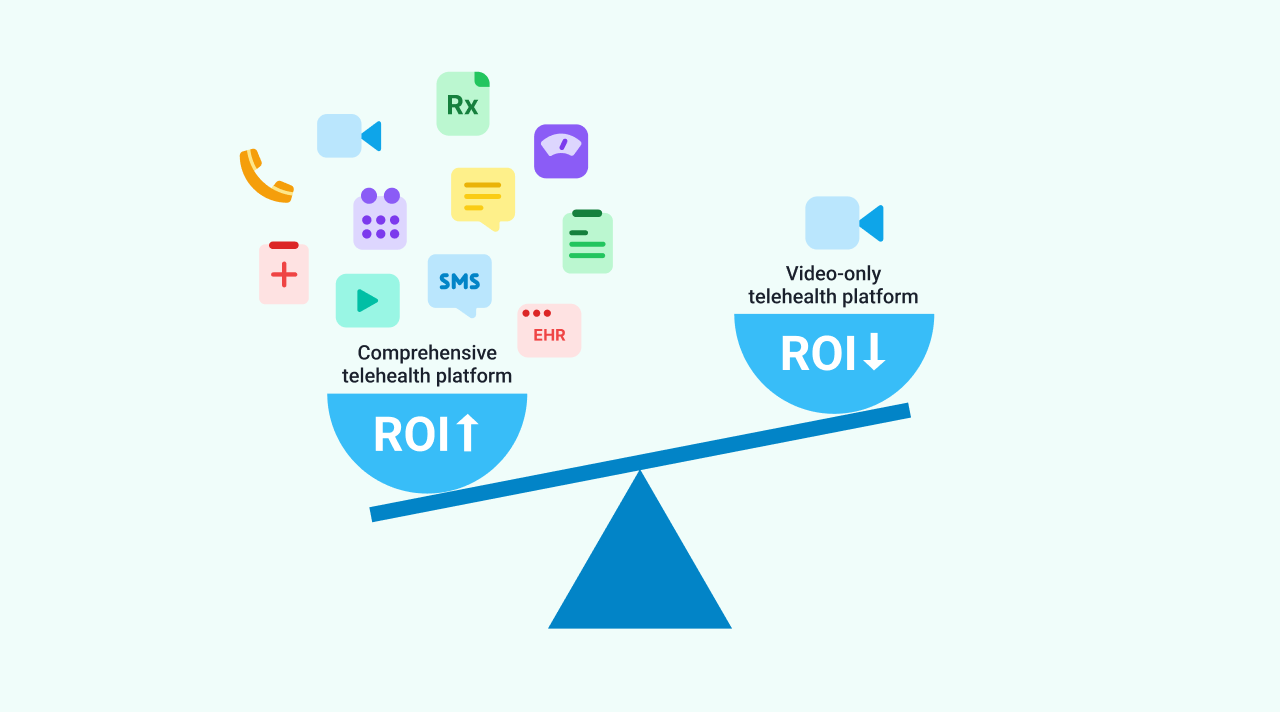

This gap between adoption and value isn’t random. It reflects fundamental misunderstandings about what telehealth can realistically deliver and how to measure success. Organizations that approach virtual care as “video visits only” struggle to break even. Those treating it as comprehensive infrastructure for care delivery see different results entirely.

The practices generating returns from telehealth platforms share common characteristics. They measure the right metrics, understand substitution versus addition dynamics, and choose platforms built for revenue generation rather than just video conferencing.

What organizations get wrong about telehealth ROI calculation

Most healthcare organizations measure telehealth ROI by counting video visits and calculating cost per consultation. This narrow view misses the broader value telehealth delivers – and sets up false expectations about revenue growth.

The typical calculation looks like this: platform cost divided by number of virtual visits equals cost per visit. If that number exceeds reimbursement rates, administrators conclude the platform isn’t profitable. But this ignores several critical factors.

First, it doesn’t account for saved overhead. Virtual visits eliminate facilities costs, reduce no-show rates (which average 5-30% for in-person appointments), and allow providers to see patients during hours when offices would otherwise be closed. A practice seeing 20% fewer no-shows immediately increases provider utilization without adding staff.

Second, the calculation misses patient acquisition value. Offering virtual care expands geographic reach and appeals to patients who might otherwise choose competitors. Many practices find telehealth attracts younger, commercially insured patients – exactly the demographic they want to grow.

Third, it ignores care coordination efficiency. Platforms that integrate scheduling, video visits, messaging, and documentation reduce administrative burden. When care coordinators can manage patients across channels from one interface, labor costs drop even if visit volume stays constant.

The organizations seeing ROI measure these broader impacts, not just visit counts. They track provider productivity gains, patient retention improvements, and operational cost reductions. These metrics paint a more accurate picture of telehealth’s financial contribution.

The substitution reality: why telehealth doesn’t always add revenue

Here’s the uncomfortable truth many organizations discover: telehealth often replaces in-person visits rather than adding new ones. A study of nine health systems found that while virtual visits grew 31-fold during the pandemic, total visits per Medicare beneficiary rose only 0.25 visits. That’s a 74% substitution rate.

This substitution dynamic affects revenue expectations dramatically. If your practice historically generated $150 per office visit and now delivers the same care virtually at the same reimbursement rate, revenue stays flat. You’ve changed the delivery method but not the financial outcome. For many organizations, this explains the ROI disappointment.

Substitution isn’t inherently bad. Virtual visits reduce facilities costs and can increase provider capacity by eliminating commute time between exam rooms. But if you budgeted for telehealth to add $200,000 in annual revenue, discovering it merely maintains existing revenue creates financial gaps.

Some visit types substitute more than others. Follow-up appointments, medication management, and routine check-ins convert to virtual care easily. New patient evaluations and procedures requiring physical examination don’t. Practices seeing the best returns strategically choose which encounters to virtualize based on clinical appropriateness and financial impact.

The key is setting realistic expectations. Telehealth works best as infrastructure for delivering existing care more efficiently, not necessarily as a pure revenue growth driver. Organizations that understand this from the start make smarter platform investments and measure success appropriately.

Remote patient monitoring vs. video visits: different economics entirely

While video-only telehealth struggles with substitution problems, remote patient monitoring (RPM) shows different economics. A Medical Economics study found primary care practices adopting RPM saw 20% Medicare revenue increases.

The difference comes down to reimbursement structure. Video visits reimburse per consultation – if you substitute virtual for in-person, revenue stays flat. RPM reimburses for monitoring time and data interpretation, creating new billable services that didn’t exist before.

A primary care practice monitoring patients with chronic conditions can bill for device setup, patient education, and ongoing data review – services that complement rather than replace office visits. A patient with hypertension might have four annual office visits plus continuous remote monitoring, generating more total revenue than four office visits alone.

This reveals an important lesson: not all telehealth capabilities deliver the same financial returns. Video visits provide patient convenience and operational efficiency. RPM creates new revenue streams. Asynchronous messaging improves care coordination. Platforms offering comprehensive capabilities – not just video – give practices more options for value creation.

Many white label telehealth platforms bundle these capabilities together. The same platform handling video consultations can support remote monitoring workflows, secure messaging, and digital intake forms. Organizations maximizing ROI use multiple platform features strategically rather than treating telehealth as synonymous with video calls.

For practices evaluating platforms, this means asking different questions. Instead of “Can patients video call my doctors?” ask “What billable services can this platform enable?” The answers determine whether the investment generates returns or just maintains the status quo.

How to measure what actually matters

If cost per visit is the wrong metric, what should organizations track instead? The practices seeing ROI focus on three categories: provider productivity, patient engagement, and operational efficiency.

Provider productivity metrics include patients seen per day, percentage of schedule filled, and revenue per provider. Telehealth should increase these numbers by reducing downtime between patients, enabling evening or weekend hours, and decreasing no-shows through reminder automation and easier rescheduling.

Patient engagement metrics track retention rates, time to appointment, and patient satisfaction scores. Virtual care access should improve all three. If your platform makes scheduling harder or forces patients through clunky interfaces, you’re creating friction that costs money through patient churn.

Operational efficiency metrics measure administrative burden, coordination costs, and resource utilization. Can schedulers book virtual and in-person visits from the same interface? Do providers access patient information without switching systems? Does the platform reduce phone tag through secure messaging?

Many organizations discover their “telehealth platform” is actually three separate tools – a video vendor, an EHR with some virtual capabilities, and a scheduling system – none of which integrate well. The labor cost of managing disconnected systems often exceeds the platform subscription fees. Comprehensive platforms reduce this hidden expense.

For example, a practice using a white label telehealth platform with integrated scheduling, video visits, patient intake, and communication sees different economics than one cobbling together point solutions. The former reduces IT complexity and administrative overhead. The latter creates ongoing integration costs and workflow inefficiencies.

The key insight: measure total cost of ownership against total value delivered, not just platform fees against visit revenue. This broader calculation reveals whether telehealth truly improves your practice’s financial health.

Three platform capabilities that separate winners from break-even operators

Organizations generating strong ROI from telehealth share common platform characteristics. These aren’t optional features – they’re fundamental requirements for value creation.

First, comprehensive workflow integration matters more than individual features. A platform handling patient intake, scheduling, video visits, documentation, and billing from one interface reduces labor costs dramatically compared to managing separate systems. Care coordinators spending 30 minutes per patient across multiple tools versus 10 minutes in an integrated platform represents real cost savings at scale.

Second, white label customization drives patient adoption. Generic platforms with “powered by [vendor]” branding create patient confusion and dilute your practice identity. Patients who access care through a platform branded as your practice – with your logo, colors, and domain – perceive it as your service, not a third-party tool. This matters for retention and referrals. Platforms like Healee provide true white label branding where patients never see another company’s name, ensuring you own the relationship.

Third, proven scalability reduces risk and speeds deployment. A platform serving 1 million patients across 200 clinics – like Healee’s technology powering Bulgaria’s largest healthcare marketplace – has encountered and solved problems you haven’t discovered yet. Edge cases around scheduling conflicts, high patient volume, and diverse workflows are already addressed. Unproven platforms require you to fund that learning curve.

These three factors – workflow integration, white label branding, and battle-tested scalability – explain much of the ROI variance between organizations. Practices choosing platforms optimized for operational efficiency and patient ownership see returns. Those treating telehealth as a video conferencing add-on struggle with costs exceeding benefits.

Platform economics matter too. Single-tenant architectures, where each practice gets dedicated infrastructure, support deeper customization than multi-tenant shared platforms. The ability to configure workflows, branding, and features specific to your practice enables optimization multi-tenant tools can’t match. However, this comes at higher base costs, making it most suitable for practices committed to virtual care as core infrastructure rather than a side capability.

What this means for practice leaders evaluating platforms

The gap between 71% weekly usage and 30% ROI achievement isn’t permanent. Organizations closing this gap make different decisions from the majority struggling with returns.

They set realistic expectations, understanding telehealth primarily improves efficiency and patient access rather than dramatically expanding revenue. They measure success through provider productivity, patient retention, and operational costs – not just visit counts. They choose comprehensive platforms over point solutions, prioritizing workflow integration and proven scale.

Most importantly, they recognize platform selection as strategic infrastructure investment, not technology procurement. The difference between a $1,000/month comprehensive platform and free video tools isn’t the subscription cost – it’s the opportunity cost of inefficient workflows, disconnected systems, and patient experience friction.

For practices still evaluating options, the key question isn’t “Should we do telehealth?” – that decision is made. The question is “Which platform approach sets us up for ROI rather than just utilization?” The answer determines whether your practice joins the 30% seeing returns or the majority still searching for value.

Organizations ready to close their own ROI gap typically start by auditing current telehealth costs against actual returns, identifying which platform capabilities drive value versus vanity metrics, and evaluating whether their current tools support or hinder the workflows that generate revenue. Many discover they’re paying for features they don’t use while lacking integrations they need.

The practices generating strong returns from virtual care didn’t stumble into success. They made deliberate choices about platform architecture, workflow design, and success metrics. The technology enabling this approach is available to any practice ready to move beyond video-only thinking toward comprehensive virtual care infrastructure.

Request a demo to explore how purpose-built telehealth platforms support revenue-positive virtual care.

Sources:

- New Data Details How Telehealth Use Varies by Physician Specialty – American Medical Association

- Nine Health Systems Show Telehealth Replaces, Not Adds Medicare Visits – American Telemedicine Association

- Remote Monitoring Boosts Medicare Revenue by 20% for Primary Care Practices – Medical Economics